Feature Spotlight: Using Candidate Availability and Placement

Gain real-time visibility into candidate availability with AviontéBOLD. Track status, reduce wasted outreach, and make faster, smarter placements.

For staffing firms, back-office data isn’t just about bookkeeping—it’s the engine that drives profitability, efficiency, and sustainable growth. In today’s competitive staffing environment, understanding cash flow, client payment behaviors, and high-performing accounts is critical. With the right dashboards in place, your team can reduce aging receivables, identify top-margin clients, and streamline payment workflows.

The secret to making smarter business decisions begins with business intelligence tailored to staffing. Back-office reporting gives staffing executives the financial visibility they need to optimize revenue streams, streamline collections, and boost overall profitability. But with so much data at your fingertips, which information truly moves the needle?

Here are three essential back-office dashboards designed specifically for staffing firms looking to turn financial visibility into a competitive advantage.

Managing cash flow is one of the biggest challenges in staffing, and the AR Aging dashboard is your go-to tool for keeping it in check. This dashboard provides a real-time view of outstanding receivables, helping you track overdue payments and spot potential risks before they turn into major cash flow issues.

Late payments and overdue invoices can disrupt operations. That’s why understanding your accounts receivable aging (or AR Aging) data is crucial. It helps you pinpoint late-paying clients, assess risk exposure, and make smarter financial decisions.

By categorizing receivables by aging brackets, you can identify slow-paying clients, prioritize collections, and even recognize which customers consistently pay on time—valuable intel for making strategic decisions about your clients that maximize financial health.

Think of this dashboard as your financial early warning system. Use it to get ahead of late payments by setting up structured follow-ups for high-risk accounts. Automated reminders, friendly nudges, and clear payment expectations can make a big difference in improving collections. For example, with our INSIGHTS analytics tool, you get detailed AR Aging data and the ability to set up automated follow-ups. Using the report manager, you can schedule emails at a set cadence, ensuring consistent and effortless communication with clients who may be at risk.

For clients who always pay on time, consider rewarding their consistency with small incentives or streamlined renewal processes. And if you notice repeat offenders, it might be time to adjust contract terms—requiring deposits, shortening payment windows, or implementing late fees.

Regularly reviewing this information ensures you stay in control of your cash flow instead of scrambling to chase overdue invoices.

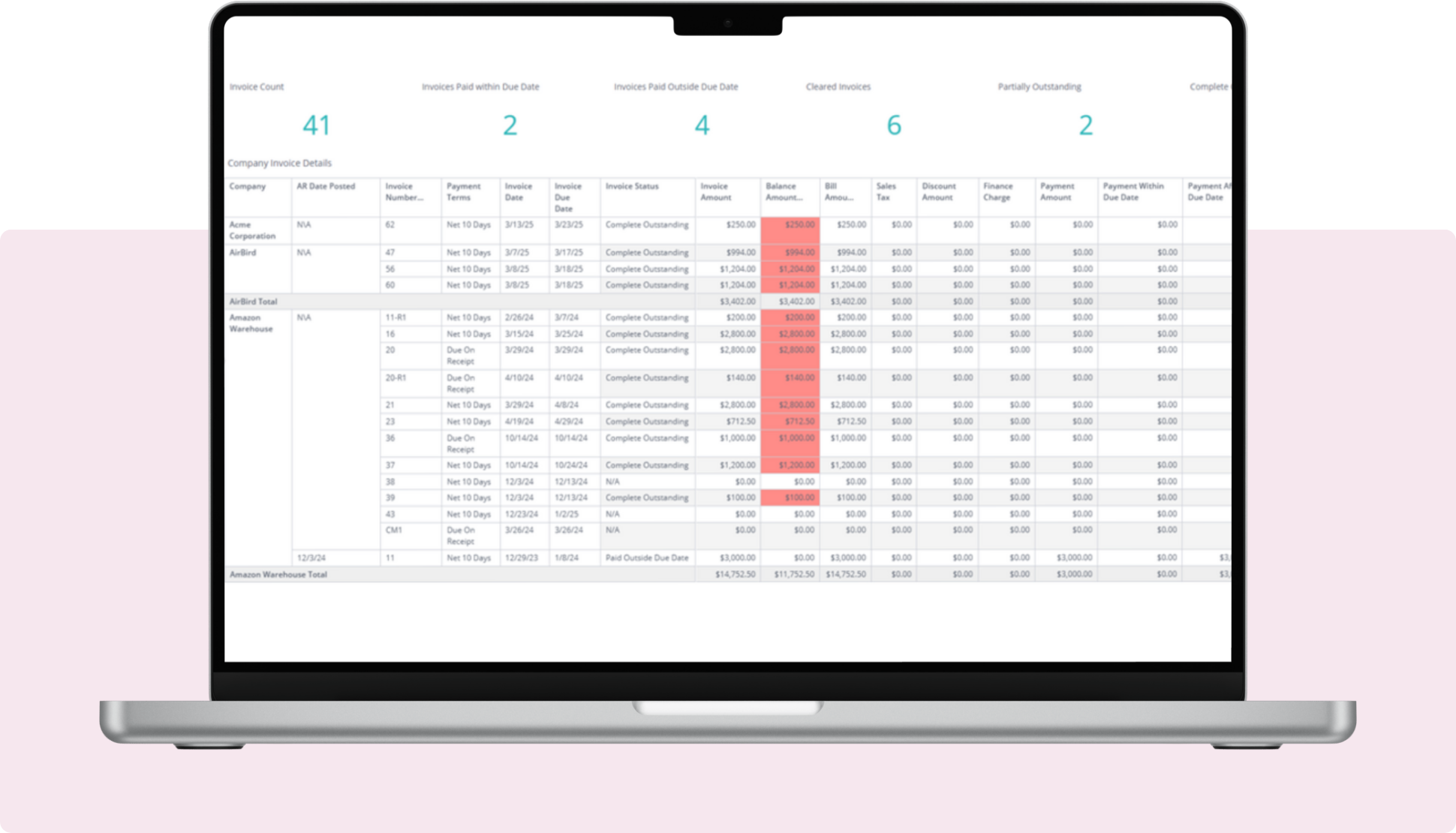

Getting invoices out is just the beginning—what really drives your business is making sure payments roll in on time. Think of the Invoice to Payment dashboard as your personal financial command center. It tracks every step of your payment process, from sending the invoice to collecting the funds, so you can quickly spot any snags, tackle delays, and fine-tune your cash flow for smoother operations.

The dashboard shows you which invoices are paid versus overdue, tracks partial payments, and calculates your Days Sales Outstanding (DSO) metrics—giving you a clear view of how long each client takes to pay. With these insights, you’ll know exactly where to streamline processes, boost client communication, and refine your collection methods—turning unpredictable cash flow into a consistently reliable revenue stream.

If payments are slowing down, this dashboard helps you figure out why. Are certain clients consistently late? Are internal delays causing invoices to go out later than they should?

By leveraging the insights provided by this dashboard, you can fine-tune your invoicing process. It also helps pinpoint if your internal processes are part of the problem—if invoices aren’t sent out promptly or if follow-ups are delayed, addressing these gaps can dramatically improve your cash flow.

Not all revenue is created equal. The Sales Summary dashboard helps you break down profitability by client, location, industry, and job type—so you can focus on what’s truly driving your bottom line.

By carefully tracking your revenue streams, alongside costs and gross profit percentages (GP%), this powerful dashboard highlights your highest-margin opportunities. It also reveals key hidden expenses—like workers’ compensation and taxes—giving you the complete profitability picture you need to make smart, strategic decisions. e profitability.

This is where data turns into strategy. Use the Sales Summary dashboard to identify your most lucrative clients and industries, then double down on those areas. If a particular sector or region consistently delivers high margins, consider expanding your services there.

On the flip side, if certain clients are barely helping you to break even, it’s time for a pricing reality check. Reassess your billing structure, standardize rates across similar clients, and ensure labor costs aren’t eating into your profits.

By keeping an eye on this dashboard, you can make data-driven decisions that don’t just grow revenue—but grow it profitably.

Back-office data isn’t just numbers on a page—it’s your roadmap to smarter business decisions and a healthy cash flow!

Want to boost profitability? Focus on high-margin clients and industries. Need better cash flow? Strengthen collections and refine payment terms. Looking to improve efficiency? Identify and eliminate delays in billing and invoicing.

By leveraging the AR Aging, Invoice to Payment, and Sales Summary dashboards, you can stay financially strong, adapt to market changes, and drive long-term growth.

At Avionté, we gather all the crucial data staffing agencies need to stay ahead and drive growth. Through our powerful Avionté INSIGHTS tool, key metrics like AR Aging, Invoice to Payment, and Sales Summary are always accessible and available at your fingertips.

Want to see how a modern staffing platform can help your staffing business be more efficient? Schedule a free consultation call today.