Integrations & APIs for a First-Class Experience

Avionté carefully selects partners with best-of-breed technology in staffing and recruiting to build a tech stack that meets your specific needs. For added functionality, Avionté’s APIs offer a proven means of customizing and expanding your system.

Provider

ADP

Integration Overview

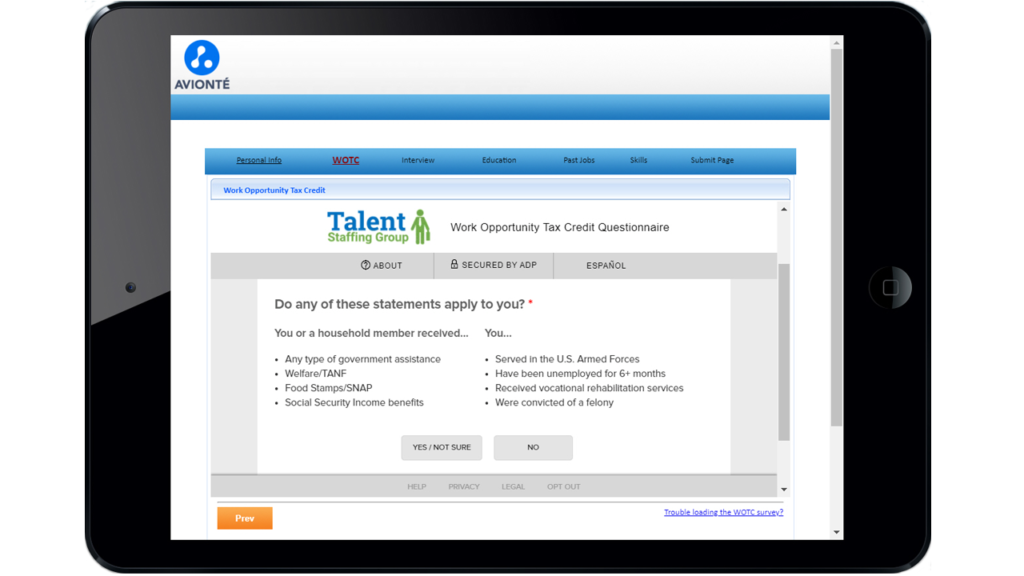

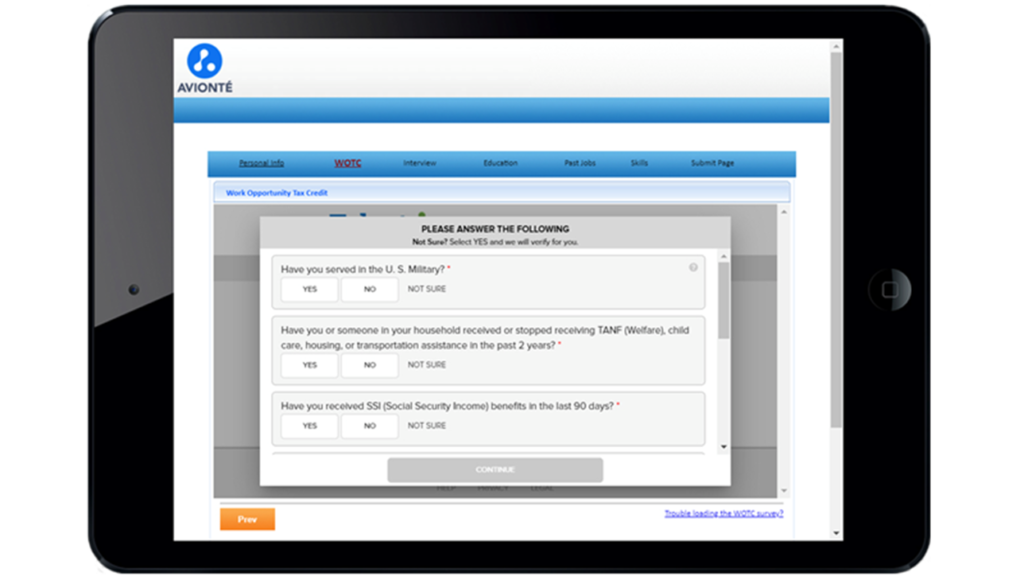

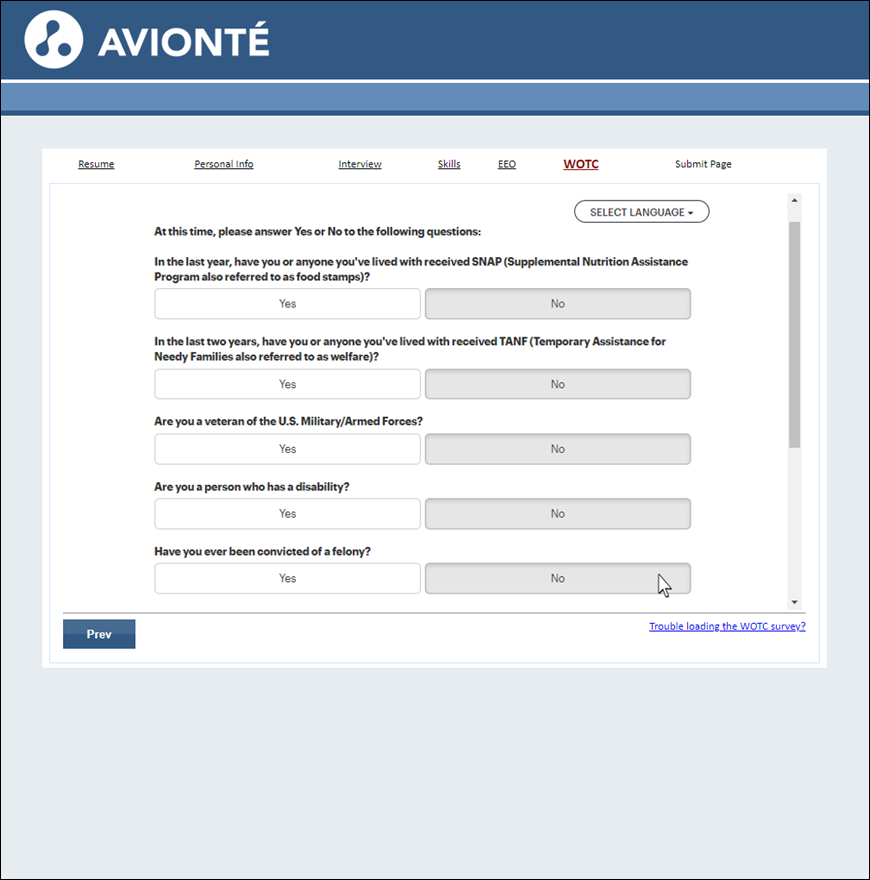

Close the Compliance Gap by identifying, securing and maximizing the tax credits for which your business may be eligible with ADP’s end-to-end service and turnkey operation. Streamlined experience for applicants, for a quick, easy and complete response. Convenient applicant screening anywhere with support for mobile smart devices and tablets. Adaptable workflow that integrates with virtually any hiring process. Intelligent WOTC analytics that provide proactive insights for improved WOTC program management. Secure platform that safeguards sensitive applicant data.

The Key Benefits

- Maximize your tax credit eligibility:

ADP’s single-page questionnaire and intuitive web and mobile app increase application rates and simplify the capture of required WOTC data. - Optimize results with financial insights:

ADP’s benchmarking, analytics and intelligent forecasting tools help maximize results and avoid financial surprises. - Touchless HR experience:

A secure yet easy fit within your hiring process that minimizes work for hiring managers.

Provider

Experian

Integration Overview

Experian is the fastest growing tax credit provider in the country, offering the most flexible and streamlined WOTC solution in the industry. With more than 25 years of tax credit experience, Experian’s clients include some of the largest and most recognizable companies in the world.

Experian’s exclusive Staffing Industry WOTC program provides a customized offering specifically designed to meet the unique needs of our staffing clients. This includes streamlined integrations, industry-specific reporting, and dedicated service resources, all in place to provide a best-in-class staffing industry WOTC experience.

The Key Benefits

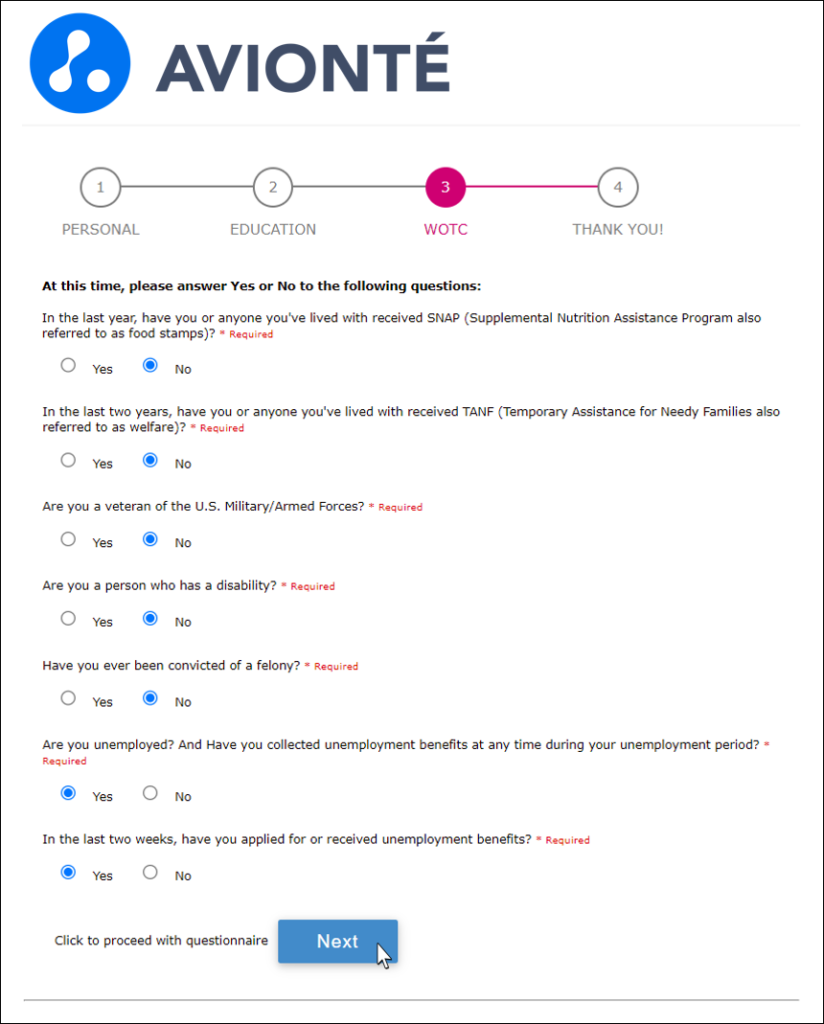

- Embedded in BOLD

The Avionté / Experian WOTC integration is designed to provide candidates with the most streamlined user experience. Consistent with the Avionté+ platform, the Experian integration embeds the WOTC questions within BOLD, eliminating the need to redirect applicants to a 3rd party WOTC. This embedded process provides a rich user experience, eliminates candidate friction, and dramatically improves the time-to-hire. - Fastest WOTC Survey

Experian’s WOTC survey is designed to be the fastest and most efficient WOTC survey in the industry. Experian asks the fewest number of questions, and applicants are not required to provide any personal information (SSN, DOB, etc.). Experian’s WOTC survey is 3 times faster than other leading WOTC providers – one of the reasons so many staffing companies have transitioned to Experian! - Automated Data Feed

The Avionte/Experian WOTC integration automatically transmits the necessary payroll information to Experian, eliminating the need to upload weekly data files. - Say Goodbye to Supporting Documentation

One of the major obstacles for a staffing company to receive a tax credit is the need to obtain documentation that proves an employee is eligible. Experian’s WOTC program includes the procurement of all required supporting documentation. Experian obtains this information directly from the applicable federal, state, and/or local agencies, resulting in the maximum credit amounts for Experian’s clients.

Provider

Equifax

Integration Overview

For decades Equifax Workforce Solutions has helped HR work smarter. From responding to income and employment verifications, to helping with hiring tax credits, we leverage unique data assets and technology with market-leading innovation to make your job easier.

Their Work Opportunity Tax Credit (WOTC) proprietary technology integrates with Avionté to provide a seamless and consistent user experience.

The Key Benefits

- Expand and enhance your workforce

- Screen for WOTC before Day One

- Pay less taxes, increase your profit

- Access unique tools that complement hiring and internal initiatives

- Let Equifax handle the entire WOTC process – from screening to reporting

Provider

Synergi Partners

Integration Overview

Synergi Partners (“Synergi”) is the largest privately-owned incentive and tax credit consulting and processing company in the United States. Synergi specializes in federal and state tax credit programs, as well as disaster relief incentives, for employers across the United States, including Puerto Rico.

Synergi was founded by tax credit industry veterans. The executive team is made up of thought leaders who have made significant contributions to the tax incentives industry. Synergi seeks to provide the best service available and expertise that helps clients realize the opportunities of each tax credit. While many companies offer consulting services for tax credits and incentives, very few are 100% focused on these services alone.

Synergi Partners has teamed up with Avionté to help employers take advantage of economic relief incentives for businesses impacted by COVID-19, plus the Work Opportunity Tax Credit (WOTC).

The ERC allows businesses impacted by COVID-19 to receive a refundable, above the line payroll tax credit. This credit was created to reward employers for retaining their employees during the 2020 – 2021 pandemic. The WOTC program rewards employers for hiring from specific targeted groups such as Veterans, food stamp recipients, ex-felons, etc.

The Key Benefits

- Save time and earn more

Quickly identify your tax credit opportunities through proprietary technology that maximizes tax credit recovery opportunities and incentives. - Work with a focused and experienced team

Synergi’s only focus is on processing tax credits, and their team understands the nuances of the staffing industry. - Stellar support

You can always count on friendly service from knowledgeable team members. - Risk free

Synergi Partners offer risk free consulting services and deliver audit ready packages, keeping employers in compliance. - CARES Act ERC ready

Through the CARES Act Employee Retention Credit (ERC), businesses impacted by COVID-19 can quickly infuse cash into their organization by utilizing the ERC – a refundable payroll tax credit. - Quality guaranteed

Synergi’s relentless passion will ensure compliance, and their services are proven, defendable, and consistent.

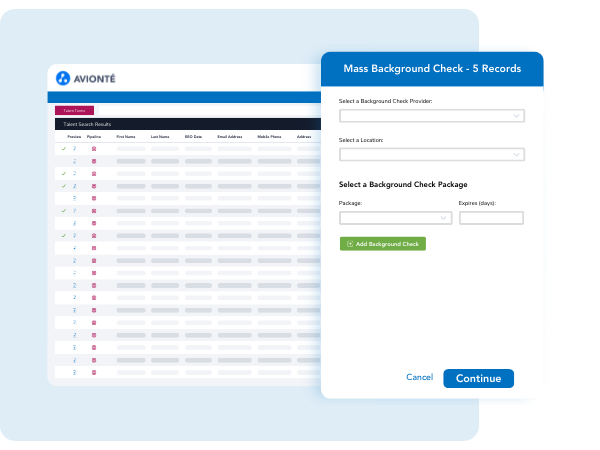

Add Power to Your Platform

Certified integrations add power to an already robust system. These customizable modifications can help you streamline workflows, improve communication and bolster data security and management – all within the original architecture of your system.

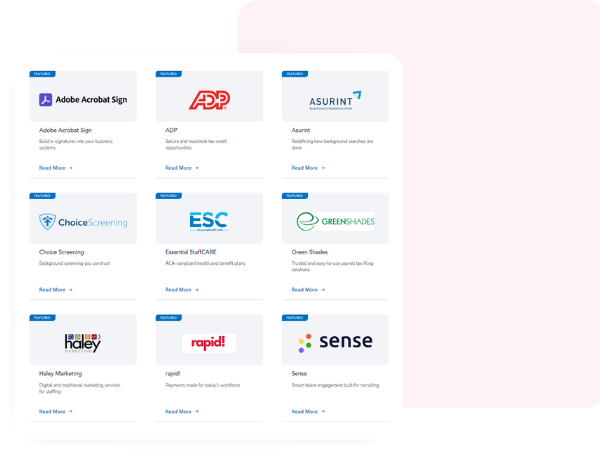

Best-Fit Integrations

We carefully hand-pick the best integrations to maximize the efficiency of your business. All steps in your workflows are considered; always with the goal of maximizing productivity and the return of your software investment.

Learn More

Enhance the Experience

A robust catalog of third-party staffing integrations allow for expanded, more appropriate functionality which translates into a more user-friendly interface – and an overall better user experience for talent, staff and customers.

Avionté+ Integrations

When evaluating a technology provider to integrate with your ATS, look for an Avionté+ Certified Integration or Avionté+ Certified Partner badge on their website to feel confident that you are selecting a vendor that has been vetted by our team — and can be trusted by yours.

Partner with Avionté+

Have a best-in-breed staffing or recruiting technology? Looking to increase your reach and grow your business? Apply to be a Certified Avionté+ Partner today.

Avionté+ Certified Integration Program

Avionté+ Certified Integration Program is your opportunity to use the Avionté Open API and create an integration to your solution.